The elimination period term refers to the period between an injury and receipt of benefits. We can say that it is the time between the beginning of injury and receiving the benefit of payment from an insurer. This term is also specified as a waiting or qualifying period. Before the payment of the benefit of claim, the policyholder has to qualify through this waiting period which is also a requirement of most insurance companies.

The elimination period can vary but commonly it is of 30 to 180 days, though sometimes maybe longer. This term is commonly used in disability and long-term insurance.

Types:

The elimination period is often seen of three types and these are:

Long-Term care Insurance Elimination Period:

Long-Term care insurance policy offers the elimination period option of 90, 180, and 365 days of the calendar. This elimination period begins on the first day when a patient is chronically ill and receives medical services.

Short-Term Disability Insurance Elimination Period:

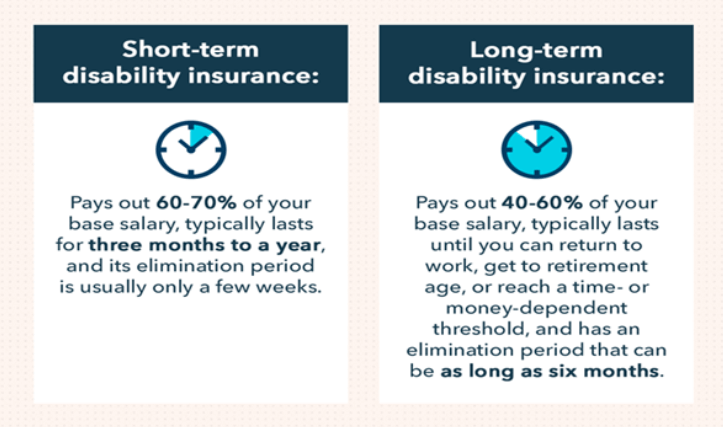

Some insurance companies offer a short-term disability policy elimination period. In this insurance plan, they offer the policyholder a choice of Elimination period of 14 to 30 days.

Long-Term Disability Insurance Elimination Period:

Some Insurance companies offer a group long term disability insurance policy in which the elimination period is of 90 to 180 days

Especially depending on the policy, the Insured may have to meet the elimination period once during the policy period.

Need to Consider while Picking the Elimination Period:

Each individual has their financial situation. So, everyone needs a different elimination period in their insurance policies, according to their needs. For example, if an employee offers a short-term disability plan then the elimination period should be taken accordingly. Additionally, Anyone can have Long-term disability insurance whereas short-term disability insurance trails off.

Here we can conclude that selecting an insurance policy with a long elimination period may save money on the premium but this might put some sticky financial situations if anyone needs coverage. Before selecting a disability or long-term care policy, it is necessary to understand how the elimination period works. This will help us to select the policy that best suits our financial situation.

Leave A Comment