What Are eDocs in Insurance?

In insurance, eDocs (Electronic Documents) refer to the electronic delivery of documents and notifications from carriers to agencies or third parties, using standard formats in ACORD XML. This helps streamline operations, reduce paper use, and enhance system automation.

These documents are typically delivered through ACORD eDocs and Messages Standards and received via platforms such as IVANS and API integrations, often in base64-encoded format within the XML structure.

eDocs are non-transactional documents sent electronically to communicate important updates related to:

- Policies

- Claims

- Billing

- Underwriting

- Compliance

1. Policy Documents

These relate to the issuance, renewal, or endorsement of insurance policies:

- New Business Policy – complete digital version of a new policy.

- Renewal Policy – renewal declarations or full policy.

- Policy Declaration Pages (Dec Pages) – summary of key policy details.

- Endorsements – changes or amendments to the policy.

- Cancellation Notices – documents regarding policy cancellation.

- Reinstatement Notices – confirm reactivation of previously cancelled policies.

- Non-Renewal Notices – inform that a policy will not be renewed.

2. Billing Documents

Related to the insured’s financial transactions:

- Invoices – billing statements for premiums due.

- Payment Schedules – outlines payment plan terms and due dates.

- Late Payment Notices – warnings about overdue payments.

- Cancellation for Non-Payment Notices – alerts before policy termination due to unpaid premium.

3. Claims Documents

- Claim Acknowledgements – confirmation of claim receipt.

- Claim Status Updates – progress reports or required actions.

- Settlement Letters – final decision and settlement offer.

- Denial Letters – if a claim is rejected.

4. Underwriting Documents

Used during policy evaluation and approval:

- Underwriting Requests – request for more information.

- Inspection Reports – home, vehicle, or business evaluations.

- Risk Assessment Reports – analyse exposure or risk factors.

5. Compliance & Legal Documents

Regulatory and legally required forms:

- Privacy Notices

- Terrorism Risk Insurance Act (TRIA) Disclosures

- State-Mandated Forms – such as flood disclosures, UM/UIM rejection forms.

- Consent Forms – such as electronic delivery consent.

6. Miscellaneous Documents

- Proof of Insurance / ID Cards – auto, liability, etc.

- Audit Notices – for commercial policies.

- Certificates of Insurance (COI) – proof of coverage, often for contractors.

- Broker of Record Letters (BORs)

Key Types of eDocs

There are two main types of eDocs based on ACORD messaging:

- Activity Notes

- Alerts

1. Activity Notes

Activity Notes are internal or external log entries related to a policy, billing, or claim file. They function like diary entries, providing a narrative of actions or events.

Characteristics:

- May be entered by carriers, agents, adjusters, or systems.

- Include a date/time, user, and note text.

- Help agencies maintain a record of interactions, tasks, or decisions.

Examples:

- “Payment of $2,300 issued to body shop on 07/07/2025.”

- “2025-07-08 10:30 – Called the insured to confirm loss details. Awaiting photos of damage.”

- “07/08/2025 10:31 – Spoke with insured; repair estimate expected by Friday.”

- “Underwriting note: Risk referred to senior UW for review.”

- “System: Claim #123456 updated from OPEN to CLOSED.”

Use Cases:

- Documenting a call with the insured

- Noting a follow-up date

- Recording system-generated status updates

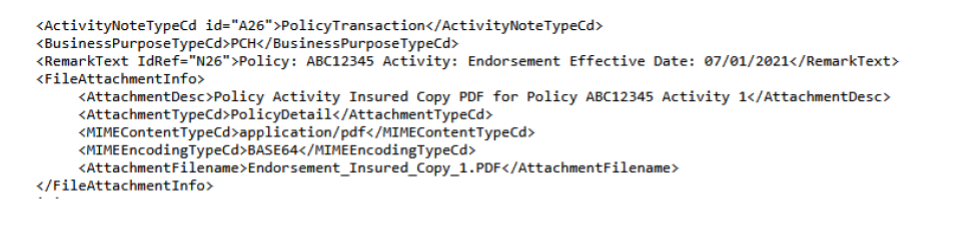

Sample XML:

Activity Note: Policy: ABC12345 Activity: Endorsement Effective Date: 07/01/2021.

2. Alerts

Alerts are system-generated notifications sent to inform the agency or system about an event or status change related to a policy, billing, or claim.

Characteristics:

- Triggered by system actions or business events.

- Delivered via AlertDownload messages in ACORD.

- May prompt the agency to take follow-up action or download a document.

Common Alert Types:

- New Policy Issued

- Claim Opened or Updated

- Payment Processed

- Document Available for Download

Example:

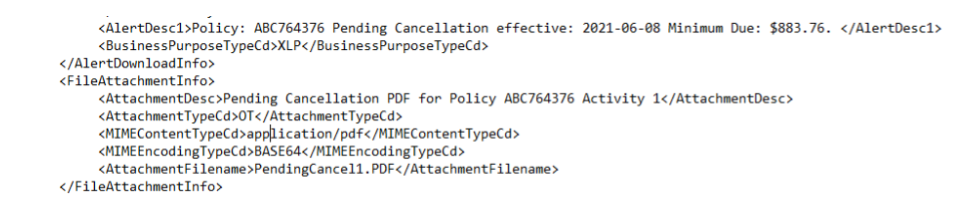

“Alert: Policy: ABC764376 Pending Cancellation effective: 2021-06-08 Minimum Due: $883.76.” Document type: Billing alert.

Sample XML:

Common AlertDownloads Triggers:

| Trigger Event | Alert Example |

|---|---|

| Missed payment / NSF | Payment missed for policy #P23456. Grace period ends in 5 days. |

| Upcoming cancellation | Auto policy #A1234 set to cancel on 2025-07-15. Reason: non-payment. |

| Claim open/closed | New claim #C98765 opened. FNOL received. |

| Policy renewal due soon | Homeowners policy #H12345 renews in 30 days. Begin review. |

| Document signature pending (e-sign) | Pending e-signature for application #L45678. |

| Policy reinstated or lapsed | Policy #A4321 reinstated as of 2025-06-28. Confirm client received notice. |

| Compliance alert (missing KYC, etc.) | Customer profile incomplete: missing KYC ID for policy #L56789. |

How eDocs, Activity Notes & Alerts Work Together

- A claim is updated in the insurer’s system.

- An Activity Note is logged detailing the adjuster’s actions.

- An Alert is generated and sent to notify the agency.

- The agency’s management system receives and may retrieve the attached document (if applicable).

Summary

| Type | Purpose | Common Triggers | Format (ACORD) |

|---|---|---|---|

| Activity Notes | Log actions, decisions, and updates | Adjuster entries, system logs | ActivityNote |

| Alerts | Notify about events/status changes | Policy/Claim changes, doc availability | AlertDownload |

In short:

eDocs = digital communication between carriers and agency/third parties.

They include Activity Notes (narrative logs) and Alerts (notifications), both of which are delivered via ACORD standards to help automate and streamline agency operations.

Leave A Comment