Insurance Coverage: Insurance Coverage is defined as the amount of risk or a potential loss including liability that has been protected by an insurance policy. Coverage mainly helps to recover the financial losses, damages that occur to property, and any health issues. For this kind of Coverages, an Individual pay an Insurance premium for a particular policy.

Comprehensive Coverage: Comprehensive coverage helps to cover the cost of damage to the vehicle when the accident is not caused by a collision and the insurance holder is also involved in that accident. It mainly covers losses like theft, hail, animal hitting so on.

Comprehensive coverage mainly acts as optional coverage which helps to protect the vehicle of the insured. It mainly covers the damages to the vehicle that are not covered in the collision may include:

- Theft

- Glass Breakage

- Fire

- Hail and Flood

- Animal Hitting

Note: Comprehensive coverage does not cover the damages caused by hitting another vehicle or object for this Insured have to use the collision coverage option.

ACORD AL3 Groups: A one-way batch communication method is designed for the policy or commission data which is known as Al3. ACORD is using this standard as a communication medium. So there is a list of groups and elements available in the AL3 standard that has been contained in the Access database.

To contain the data of coverages there are separate AL3 groups are available in the Al3 standard files. All these groups vary according to the nature of the line of Business.

- For the Commercial Line of Business; there is a 5CVG group named “Commercial Lines Coverage Group” contains the data of coverages in it

- For the personal line of Business (except AUTOP): there is a 6CVH group named “Homeowners and Dwelling Fire Coverage and Adjustments Group” that contains the data of coverages in it.

- For Personal Automobile Policy, there is a group named “Personal Automobile Coverage and Adjustments Group” (6CVA) that is used to contain the data of coverages in it.

All these groups contain a list of elements in them. Most of the elements are quite similar. So majorly if we want to use the data of coverage, we need to use an element named “Coverage code” first. To get the value of the coverage, we need to check the code from the Al3 code list table available in the ACORD database.

We can also add the limits, deductible, and values for premium in the same group on the basis of that coverage code.

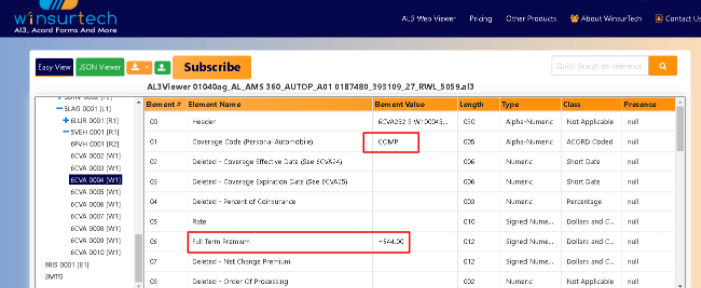

So the Comprehensive coverage code is also found in the code list table (coverage code for Comprehensive coverage is “COMP”), from there we can take its coded value and will use it as a value of the “coverage code” element in the group. Also the amount of limit, deductible and premium can also be added in the same coverage group. (We can choose the coverage group according to the line of business as mentioned above). A screenshot of the reference (contains data of Comprehensive coverage) is attached below:

You can also open the al3 file in the same al3 viewer to get more details about the coverage groups and elements of the AL3 structure. The link to the website is also attached: https://products.winsurtech.com/al3-web-viewer.

Leave A Comment